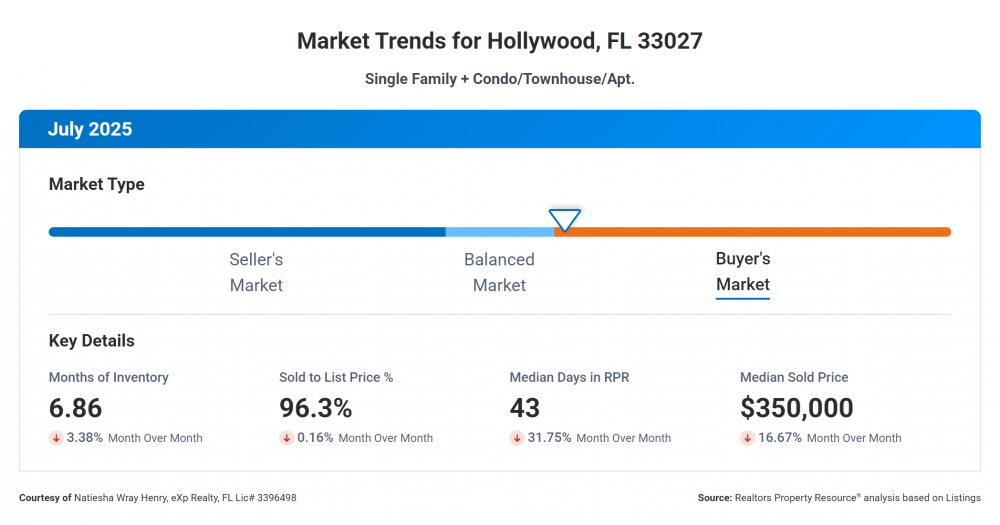

As we move into the fall of 2025, the South Florida housing market is shifting in a way that puts first-time buyers back in the driver’s seat. While these changes are playing out across the country, I’m focusing on Miramar’s 33027 neighborhood to show exactly what these trends mean for buyers right here at home.

For years, renters and new buyers felt priced out by rising home values and overwhelmed by competitive bidding wars. But now, higher inventory, longer days on market, and a rebalancing of supply and demand are creating opportunities that didn’t exist just a year or two ago.

According to Nadia Evangelou, senior economist at the National Association of Realtors, “The housing market is at a turning point.” For buyers—especially first-time buyers—that turning point means one thing: leverage.

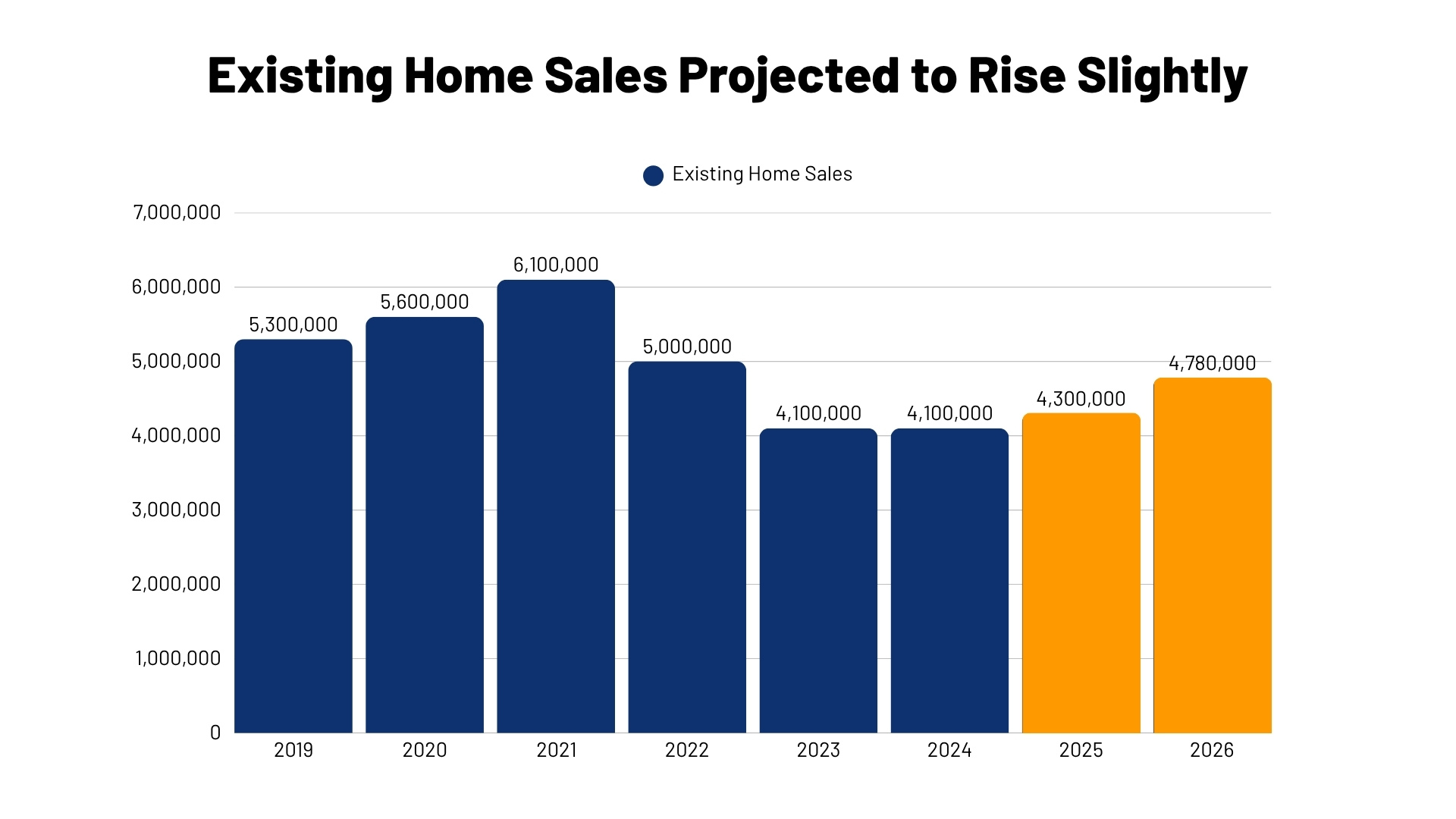

FEWER HOME SALES, BUT MORE BREATHING ROOM FOR BUYERS

Nationally, sales activity is still below pre-pandemic norms. 2,3 Many potential buyers remain cautious due to economic uncertainty and affordability challenges driven by elevated mortgage rates and home prices.4

As Lawrence Yun, Chief Economist for the National Association of Realtors, explains, “Home sales have been at 75% of normal or pre-pandemic activity for the past three years, even with seven million jobs added to the economy. Pent-up housing demand continues to grow, though not realized. Any meaningful decline in mortgage rates will help release this demand.”3

Yet, change is in the air. An increase in inventory, coupled with selective price reductions, is creating renewed interest among buyers. The good news: in 33027, homes are sitting on the market longer—giving you time to make thoughtful decisions rather than rushing to beat out a dozen competing offers. Hannah Jones, senior economic analyst at Realtor.com, told Newsweek in May, “This summer’s housing market is expected to display familiar seasonal patterns, such as increased home sales and rising prices, but overall activity may remain subdued as buyers contend with elevated housing costs.”5

What it means for first-time buyers in 33027: This slower pace works in your favor. With less competition, you can shop with confidence, negotiate on terms, and avoid the frenzied “panic buying” that defined 2021 and 2022.

For sellers, success lies in understanding today’s buyer mindset and pricing your home to reflect current market dynamics. We’re here to help you analyze local trends and craft a strategy that gets results.

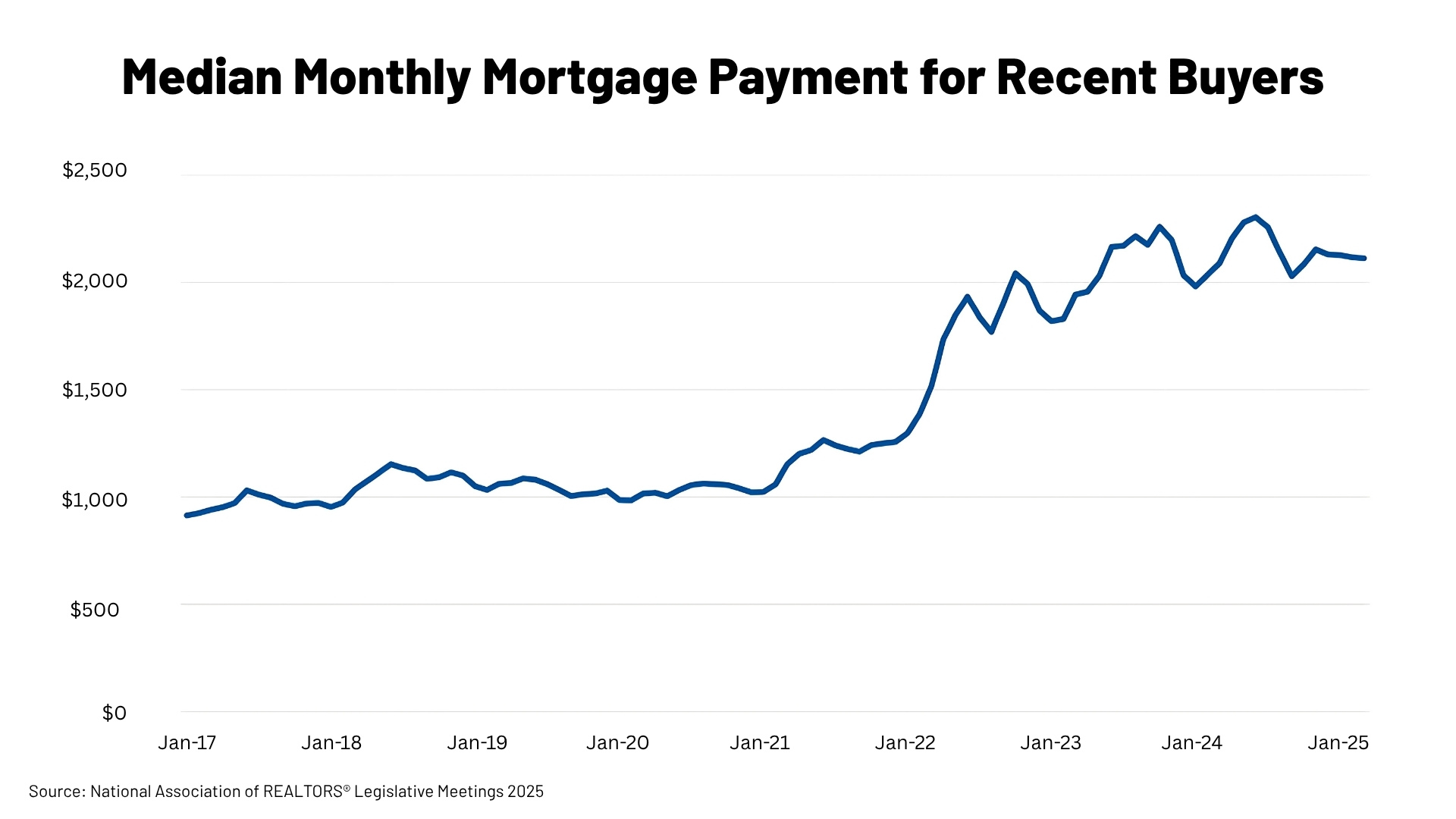

MORTGAGE RATES REMAIN ELEVATED BUT STABLE

Currently, 30-year fixed mortgage rates are hovering below 7%, and Yun expects them to average 6.4% in the second half of the year.6 While this is a far cry from the sub-3% rates of the pandemic era, it’s becoming the new normal. “Persistently high mortgage rates mean affordability remains top of mind,” explains Jones.5

For many would-be buyers, affordability challenges are now central. Monthly housing payments have more than doubled since the pandemic, not only due to higher home prices but also because mortgage rates are amplifying the cost of borrowing.7 In response, builders and sellers alike are offering concessions—from interest rate buydowns to closing cost assistance.8

What it means for first-time buyers in 33027: Don’t let rates scare you off. Instead, use your new negotiating power to ask sellers for help with closing costs or rate buydowns. And remember—you can always refinance later if rates drop.

Sellers take note: Offering mortgage rate incentives or closing cost support can set your listing apart and expand your pool of qualified purchasers. We can help you evaluate your options and market these perks to today’s cost-conscious buyers.

INVENTORY IS GROWING- AND THAT’S A GAME CHANGER

One of the most significant shifts in 2025 is the dramatic change in housing supply. Here in 33027, we’re seeing more single-family homes hit the market, with supply up compared to last year. For the first time in recent history, there are far more active sellers than buyers—an estimated 33.7% more.

This reversal stems from a combination of factors: the return-to-office trend has cooled demand in previously hot markets, while affordability issues continue to keep many potential buyers on the sidelines. At the same time, a growing number of homeowners—tired of waiting out market uncertainty—are choosing to list their properties, further swelling the supply.9

Many major metros are now considered buyer’s markets, especially in the South and on the West Coast. Homes are sitting on the market longer, and stale inventory is piling up. “The balance of power in the U.S. housing market has shifted toward buyers,” says Redfin senior economist Asad Khan.9

What it means for first-time buyers in 33027: More inventory = more choices. You’re no longer forced to compromise on must-haves just to get into a home. Whether you’re looking for a starter single-family or something with room to grow, there’s a better chance you’ll find it this season.

For sellers, we can develop marketing strategies to move your home efficiently, even in a competitive landscape.

HOME PRICES ARE SOFTENING, BUT STILL HOLD LONG-TERM VALUE

After years of rapid price growth, the market is seeing a gentle descent back to earth. Home prices nationally are flattening, with some softening here in South Florida as well. In 33027, values remain strong compared to pre-pandemic levels, but the breakneck increases have cooled. Newsweek reports that home values declined in over half the U.S. states during the first half of 2025, especially in the Sun Belt region.5

Economists forecast that the median U.S. home price will remain flat in the third quarter and dip about 1% year-over-year by the end of 2025.8 Sellers are beginning to accept that sky-high comps from 2021 and 2022 are no longer relevant–-largely due to persistent affordability challenges.

Households earning $75,000 a year can now afford just 20% of homes on the market—down sharply from nearly 50% before the pandemic.1 This shift is driven in part by a chronic shortage of housing supply, which continues to keep prices out of reach for many would-be buyers despite recent softening.10

This ongoing supply shortage is expected to prevent a significant drop in home values. As finance expert Michael Ryan tells Newsweek in May, “The housing market isn’t crashing dramatically, more like it’s finally coming back down to earth from a sugar high.”5

What it means for first-time buyers in 33027: While affordability is still a challenge, today’s softer prices and motivated sellers open doors that were locked tight two years ago. Instead of competing above asking, you may be able to secure a home at—or even below—list price.

For sellers, the key is realism. “Gone are the days when you could slap any old price on your house and expect a bidding war,” says Ryan. Strategic pricing from the start is crucial. We can help determine what your home is truly worth in today’s market.5

WHY FIRST-TIME BUYERS SHOULD ACT NOW

If you’ve been renting in Miramar and waiting for the “right time,” this may be your opportunity:• Less competition means less pressure to settle.• More inventory means more choices.• Negotiating power means you can ask for seller credits, repairs, or rate buydowns.As a first-time buyer, you are in a stronger position than you’ve been in years.

Buying your first home can feel overwhelming, but you don’t have to do it alone. This September, I’ll be presenting at the HUD-Certified First-Time Homebuyer Workshop to walk new buyers through the process and show you how to make today’s market shift work in your favor.

If you’re a seller, your strategy should reflect today’s conditions, not yesterday’s highs. And if you’re a homeowner, now is a good time to evaluate whether it makes sense to stay put, refinance, or take advantage of current equity to make a move. The best decision is an informed one, and that’s where a trusted real estate professional comes in. We have the local insight, negotiation skills, and market knowledge to help you succeed—whether you’re buying your first home, selling your third, or simply weighing your next move. Reach out today to start a conversation about your goals and how the current market can work for you.

The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for advice regarding your individual needs.

Sources:

- National Association of Realtors – https://www.nar.realtor/newsroom/americas-housing-affordability-gap-persists-households-earning-75000-annually-can-afford-less-than-a-quarter-of-for-sale-home-listings

- Zillow – https://www.zillow.com/research/home-value-sales-forecast-33822/

- National Association of Realtors – https://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales

- MarketWatch – https://www.marketwatch.com/story/home-buyers-are-finding-the-silver-lining-in-a-stalled-housing-market-especially-if-theyre-in-this-group-1bd9eaff

- Newsweek – https://www.newsweek.com/map-shows-home-values-dropping-half-country-housing-market-shifts-2074904

- National Association of REALTORS® Residential Economic Issues & Trends Forum – https://www.nar.realtor/newsroom/nar-chief-economist-lawrence-yun-says-mortgage-rates-fast-rise-hurt-housing-market-during-realtors-legislative-meetings

- National Association of REALTORS® Legislative Meetings 2025 https://cms.nar.realtor/sites/default/files/2025-06/2025-realtors-legislative-meetings-residential-economic-issues-and-trends-forum-lawrence-yun-presentation-slides-06-03-2025.pdf?_gl=1*166ceye*_gcl_au*MTUxMjAyMjU3Ny4xNzQ2ODI4MDcz

- Redfin – https://www.redfin.com/news/home-price-forecast-decline-2025/

- ResiClub – https://www.resiclubanalytics.com/p/housing-market-now-has-500000-more-home-sellers-than-homebuyers-redfin

- Realtor.com – https://cms.nar.realtor/sites/default/files/2025-06/2025-realtors-legislative-meetings-residential-economic-issues-and-trends-forum-danielle-hale-presentation-slides-6-3-2025.pdf?_gl=1*166ceye*_gcl_au*MTUxMjAyMjU3Ny4xNzQ2ODI4MDcz